Don't we all love an all-in-one digital tool like Bluevine Business Checking for snazzy small biz banking? Low fees, fab budgeting, hefty interest—you name it. Manage everything from your phone and Breeeeeeeath easy with its sick security features and nationwide access. Check out their site for the 411!

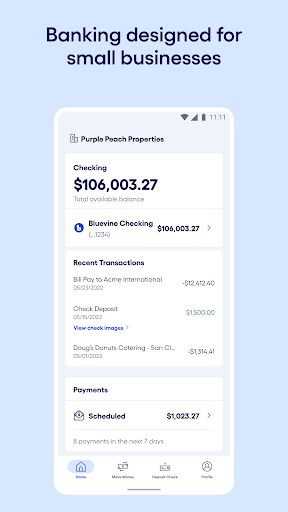

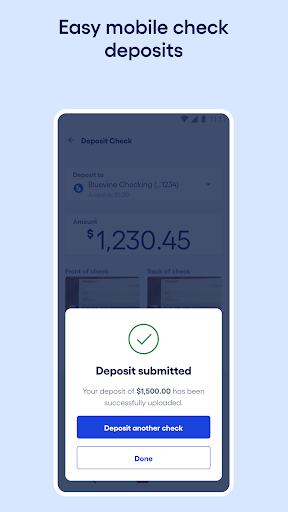

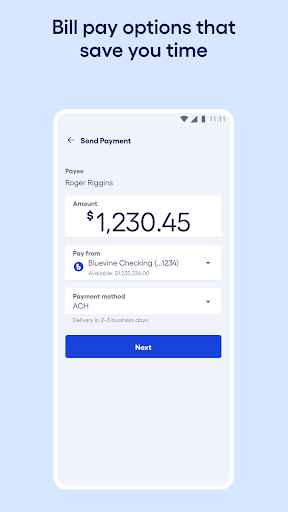

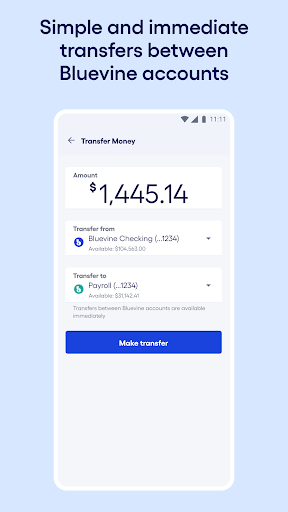

💼 Bluevine Business Checking is the ultimate account built for simplicity, bringing the digital banking experience to life! With the Bluevine Business Checking app, you can easily manage cash flow, pay bills, track transactions, and deposit checks from your phone. 📲

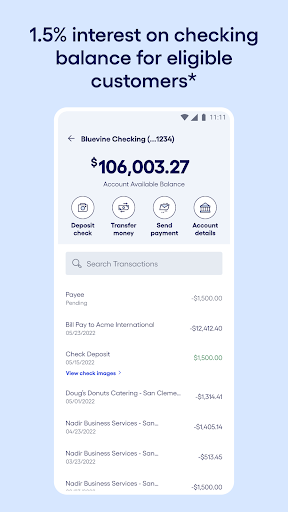

💰 Earn More Interest

Eligible customers can earn competitive interest on balances up to $3 million with our Business Checking program. 👌

💸 No Monthly Fees

Deposit and pay as you go, with no transaction limits! And save on monthly fees, overdraft fees, and no minimum deposit or balance requirements. 😉

🗂 Better Budgeting with Multiple Accounts

Now you can manage up to 5 sub-accounts to budget for taxes, payroll, and other expenses. Each sub-account has its own account number, helping you stay on top of your finances! 📊

🏦 Bank Anywhere

Deposit, transfer, and pay bills on your mobile device. Plus, deposits and withdrawals are available at over 37,000 MoneyPass locations nationwide. 🌍

🔒 Advanced Security

Bank with confidence. Bluevine accounts are FDIC-insured through Coastal Community Bank, with up to $3 million in protection. We protect your Bluevine account with world-leading security protocols, like instantly locking your debit card if it’s lost or misplaced. 💪

For more information, visit: https://www.bluevine.com/ccbx-checking-agreement/

📰 Bluevine Media Coverage

“Bluevine has demonstrated a successful track record with multiple financing products and stands out with its innovative platform vision for small business banking products.” -TechCrunch

“There is no bank we know of that is designed and built specifically for small businesses. We’re doing just that.” -Banking Dive

📜 Legal Notice

Bluevine is a fintech company, not a bank. Banking services are provided by Coastal Community Bank, member FDIC. Bluevine accounts are FDIC insured through Coastal Community Bank and provide protection up to $250,000. The Bluevine Business Debit Mastercard® is issued by Coastal Community Bank under license from Mastercard International Incorporated and may be used everywhere Mastercard is accepted.

Mastercard is a registered trademark and the circles design is a trademark of Mastercard International Incorporated.

Bluevine Privacy Policy: https://www.bluevine.com/privacy-policy/

Coastal Community Bank Privacy Policy: https://www.coastalbank.com/privacy-notice.html

* Premier and Plus plan customers automatically earn interest on available balances. Standard plan customers earn interest on deposit balances after meeting the eligibility requirements detailed in the Bluevine Business Checking Account Agreement. **Unlimited transactions, but checking account is subject to monthly deposit and withdrawal limits of the User Agreement. ***Subaccounts can only be opened on the desktop or mobile browser version of the Bluevine dashboard. The Bluevine Business Debit Mastercard is available for use with the primary Bluevine Business Checking Account only. **** Bluevine charges a $2.50 fee for ATM transactions outside of the MoneyPass® network; additional fees for third-party ATMs may vary by ATM operator.